Ponzi scheme

Share

A Ponzi scheme is a fraudulent investing scheme in which returns are paid to existing investors from funds contributed by new investors, rather than from profit earned. The scheme leads investors to believe that profits are coming from legitimate business activities, when in fact they are coming from the contributions of new investors.

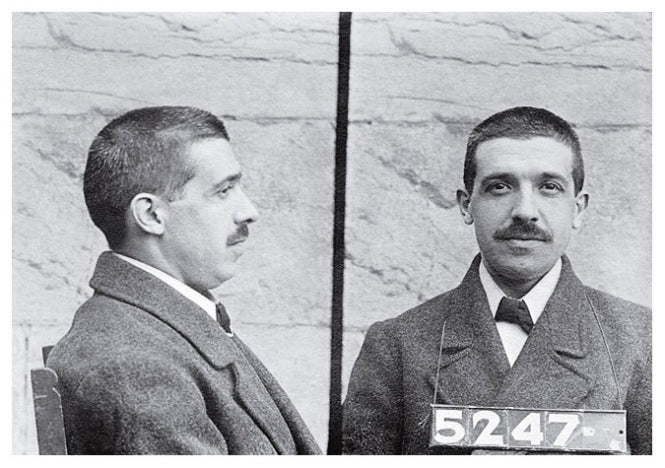

The scheme is named after Charles Ponzi, who became infamous for using this technique in the early 20th century.

Typically, Ponzi schemes offer returns that are too good to be true and are often operated by people with little or no financial experience. They may also pressure investors to recruit new investors to earn higher returns.