Understanding Level 2 Market Data: A Comprehensive Guide for Traders

Share

The world of stock trading can be complex and daunting, especially for beginners. One crucial concept that traders of all levels should understand is Level 2 market data. This guide will delve into what Level 2 market data is, its importance, how to interpret it, and tips for both novice and experienced traders on leveraging this data to make informed trading decisions.

What is Level 2 Market Data?

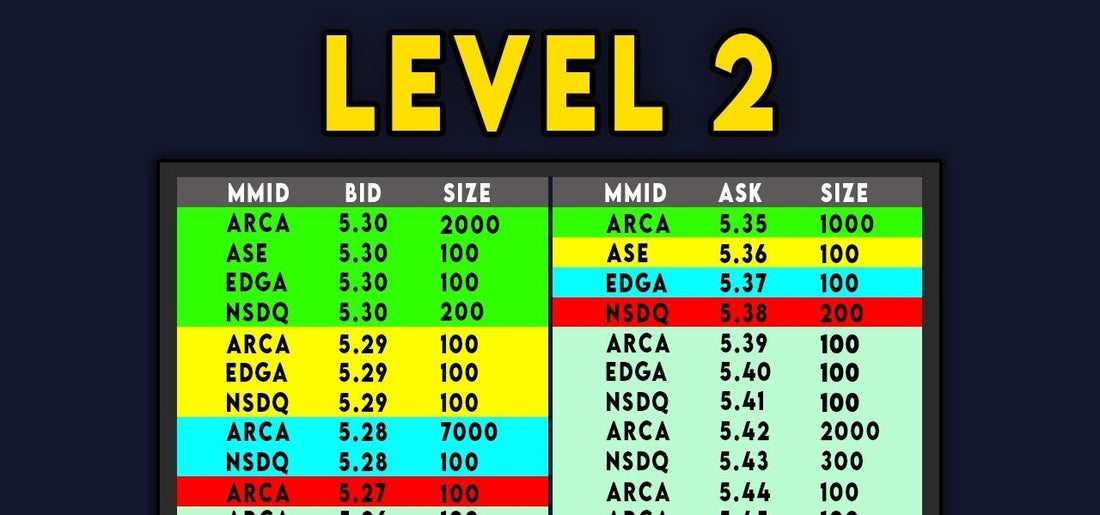

Level 2 market data provides a deeper and more detailed view of a stock's trading activity than the more commonly known Level 1 data. While Level 1 data offers basic trading information such as the current bid and ask prices, and the last traded price, Level 2 market data goes further by showing the full range of buy and sell orders in the market. This includes the price levels buyers are willing to purchase at (the bid prices) and the price levels sellers are willing to sell at (the ask prices), along with the volume of shares available at each price level.

Why is Level 2 Market Data Important?

Understanding Level 2 market data is crucial for traders looking to gain a competitive edge in the market. It provides insights into the supply and demand dynamics of a stock at different price levels, which can help in predicting the stock's price movement. By analyzing this data, traders can better time their entry and exit points, identify potential support and resistance levels, and gauge the strength or weakness of a price trend.

How to Interpret Level 2 Market Data

Interpreting Level 2 market data involves analyzing the order book, which displays all buy and sell orders in the market for a particular stock. Here are some key aspects to focus on:

Bid and Ask Prices: The highest bid price indicates strong buying interest, while the lowest ask price shows where sellers are willing to exit. A narrow bid-ask spread often signifies a liquid market.

Order Depth: This shows the volume of shares available at different price levels. Large orders at a particular price level may act as a barrier, creating potential support or resistance levels.

Market Makers: These are firms or individuals that provide liquidity by constantly buying and selling. Monitoring their activity can provide insights into market sentiment.

Tips for Beginners

For those new to trading, here are a few tips on how to use Level 2 market data:

Start with a Simulator: Practice interpreting Level 2 data using a trading simulator before risking real money.

Focus on Liquid Stocks: These stocks have more Level 2 activity, making the data more reliable for analysis.

Keep It Simple: Initially, focus on understanding the basics, such as how bid and ask prices move and what they indicate about market sentiment.

Advanced Strategies for Experienced Traders

Experienced traders can delve deeper into Level 2 data analysis to refine their strategies:

Identify False Breakouts: By analyzing order depth, you can spot large orders that might prevent a stock from breaking through a certain price level, helping you avoid false breakout traps.

Scalping: This strategy involves making quick trades to profit from small changes in price. Level 2 data is crucial for identifying the best entry and exit points for such trades.

Reading Market Makers: Some advanced traders try to decode the activity of market makers to anticipate short-term movements.